News

22 November 2023: Consider paying super monthly

Superannuation – it’s an important part of our society as it’s the savings plan for all of us when we enter our twilight years.

I’ve noticed that many clients are unsure about the best way to pay their super obligations so this is intended to offer some solutions.

Super is generally required to be paid at least quarterly. It’s due by the 28th of the month following the end of the quarter, so for the quarter from 1 October to 31 December it’s required to be paid into the employees’ super funds by 28 January. Processing super can take a few days so it’s beneficial to process the payment at least 5 business days in advance. Missing this due date means super is not deductible and the ATO will hit you with late interest and penalties.

While paying quarterly is common practice, there are some benefits to paying super monthly instead.

Firstly, it can help to even out cash flow for your business. By making regular payments, you can avoid large lump sums that can strain your finances.

It can also help to ensure that your employees’ superannuation is paid on time, every time. This helps to reduce the risk of late payments and penalties.

Lastly, paying monthly can help to improve employee morale and retention. When employees know that their superannuation is being paid regularly, they’re more likely to feel valued and appreciated. This can lead to increased job satisfaction and reduced turnover rates.

So, if you’re looking for a more manageable and beneficial way to pay your super obligations, consider switching to monthly payments.

And if you really want to shake things up make the payment every time you pay your payroll. You can pay the wages to your staff, and pay their super at the same time. Nothing more to worry about!

6 June 2023: A few quick wins to maximise your refund

30 June is almost here, so this is the time for everyone to review their finances and make sure they’re taking steps to maximise their tax refunds. By ticking off a few important items, you can hopefully bring down the amount of tax you’ll pay and increase your refund. I’ll be setting out a few ways to make sure you’re paying the least tax legally possible this tax time.

Keep your paperwork in order

This one is fundamental – make sure you have all your documentation in order. Get your receipts, (bank statements can work for some expenses), working from home logs, kilometres travelled in your personal car for work and anything else relevant. A big one here is crpyto. If you’ve traded crypto in the 2023 financial year get a report printed out of your transactions, preferably in excel format. This will help you claim all eligible deductions.

Know your deductions

Back to basics here – claiming deductions reduces your taxable income and hence your tax bill. Have a think about the following:

a) Work-related Expenses: professional memberships, education costs, software you use in your work or other equipment such as laptops or iPads can all be claimed.

b) Donations: Donations made to registered charities called Deductible Gift Recipients are tax-deductible. If you’ve made any contributions during the financial year, get your receipts ready for your tax appointment. Remember – a lot of donations are online so you’ve likely got a receipt kicking around on your email somewhere. It might even be time to make some last-minute donations!

c) Home Office Expenses: With the rise of remote work, most workers can claim home office deductions. Keep records of any expenses related to your home office setup, such as hours worked from home, internet costs and office supplies.

Pre-Pay Expenses

By pre-paying certain expenses before the end of the financial year, you can bring forward deductions and reduce your taxable income. Consider expenses such as:

a) Income Protection Insurance: If you have an income protection policy, you can claim a deduction by prepaying the next year’s premium before June 30th.

b) Investment Loan Interest: If you have an investment property or investments financed by loans, prepaying the interest for the next financial year can increase your deductions.

Boost your super

Super contributions are an effective way to reduce your taxable income. Seek financial advice in this regard as additional super contributions need to fit in with your overall personal wealth strategy. If you do make additional concessional (pre-tax) contributions to your super fund, such as salary sacrifice or personal deductible contributions, these are generally taxed at a lower rate, and reduce your taxable income and tax bill.

Chat to an accountant

Paying the least amount of tax legally possible can be complex, especially when considering individual circumstances and changing tax laws. Seeking professional advice from an accountant can ensure you’re making the most of available deductions and strategies. An expert can help you navigate the intricacies of tax planning. And the fee you pay to them is deductible!

10 May 2023: Federal Budget Measures and their impact on small businesses and individual taxpayers

It’s budget time again! Yes the 2023 federal budget was released last night, and I wanted to provide a quick overview of the important sections that have an impact on my clients – small businesses and individual taxpayers. I’ll ignore the irrelevant parts of the budget and focus on the highlights:

Instant Asset Write-Off

The instant asset write-off threshold which did not have a limit up to 30 June 2023 will be reintroduced at $20,000 from 1 July for the coming 12 months. This allows small businesses with an annual turnover of less than $10 million to instantly deduct the entire cost of certain assets that are first used between 1 July 2023 and 30 June 2024.

Environmental Measures

Small and medium-sized businesses will be incentivised to purchase energy-efficient assets through the small business energy incentive measure, allowing them to deduct an additional 20% of the cost of eligible depreciating assets.

Energy bill relief will be provided to small businesses as part of a scheme primarily aimed at welfare recipients.

ATO efforts

The government will continue to fund efforts to crack down on businesses not paying goods and service tax (GST) to boost tax revenues. Additionally, the ATO will be given additional funding to follow up compliance on other areas of tax collection. The long and the short of this will be that the ATO will have even greater power when it comes to catching out tax evasion.

If you’ve got any specific questions or concerns about the budget or how it impacts you, please don’t hesitate to reach out. As always, I’m here to assist you with any accounting or taxation matters.

3 April 2023: Planning for end of year tax

Tax

planning is crucial for individuals and small businesses alike. I know it’s only 1 April but that means that the end of

the financial year is actually approaching fast and that it’s time to start thinking about tax

planning before 30 June. If you leave your tax planning to the last week in June it’s likely you’ll run into issues – you might not have the cash available to enact your strategies and you could be left paying more tax than you could have.

Tax planning involves identifying tax strategies to reduce your overall tax liability. Whether this is at a company, trust or individual level, It involves reviewing your financial situation to date, forecasting your end of year results and implementing strategies to minimise your tax situation. Tax planning isn’t just about reducing your tax bill; it’s also about ensuring that you’re complying with tax laws and regulations.

Here’s a quick rundown of the benefits of tax planning:

1. Reduce Your Tax Liability: The primary benefit of tax planning is that it can help you reduce your tax bill. By reviewing your income and expenses, we can identify deductions that you’re eligible for, thereby reducing the amount of tax you owe.

To sum up, tax planning is a vital aspect of planning for both individuals and small businesses. By reducing your tax liability, improving your cash flow, planning for the future, and avoiding penalties and interest charges, you can make sure you’re doing everything you can to be on top of your finances. I’ll be sending out an email offering tax planning soon so keep an eye out for this. If you want to get on the front foot and get your tax planning kicked off soon then feel free to get in touch.

8 February 2023: Staying Safe From Scammers

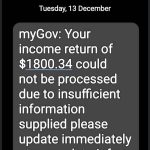

Whether you’re running a business or working as an employee in one, you need to be vigilant in protecting your personal and financial information from dodgy cyber criminals. We seem to be subject to an endless barrage of scams targeting individuals and small businesses in Australia whether it be text messages claiming to be from the ATO/MyGov or fake invoices sent from a scammer pretending to be a supplier. Here are some tips to help you stay safe and alert to these scams:

Verify the source: If you receive an unexpected text or email, don’t respond immediately. Instead, verify the source by contacting the organisation directly using their known phone number or email address.

Look for red flags: Scammers often use pressure tactics, such as threatening legal action or imposing a deadline for payment. Look out for these red flags and take the time to verify the information before responding.

Keep software updated: Regularly update your computer and its security software to protect your devices and information from cyber

threats.

Be cautious of attachments: Don’t open attachments or links from unknown or suspicious sources. These can contain malware or viruses that can get into your computer and steal sensitive personal and/or financial information.

Use strong passwords: Make sure to use strong and unique passwords for all your online accounts, and consider using a password manager

to keep track of them. Personally I use Dashlane – it’s a great tool that syncs across devices and makes life super easy.

Keep sensitive information secure: Store all sensitive information, such as personal identifying information, electronic copies of bank statements or dividend statements etc, in a secure location, and never share it with anyone over email.

Don’t delete your message history (heard this one just today!): When your bank sends you a verification text for a transfer or other communication it will usually come from the same number each time. By keeping this message history you’ll know whether a new message claiming to be from your bank actually originated there by seeing whether the other previous messages appear in the message chain.

By following these tips, you can protect yourself and your business or employer from cyber-jerks.

If you ever have any questions or concerns about tax related correspondence that you think might be a scam reach out to me and we can have a look at it.

20 January 2023: 5 Tips for Managing your Business Finances

5 Tips for Managing Your Business Finances:

As a business owner, it’s important to stay on top of your finances in order to ensure the success and growth of your business. Here are five tips to help you manage your finances:

1. Understand tax laws: Australia has a complex tax system, so it’s essential to understand the laws and regulations that apply to your business. This includes knowing your obligations for GST, income tax, Fringe Benefits Tax and other taxes.

2. Keep accurate records: Keeping accurate and detailed records of your transactions is crucial for compliance with tax laws and for making informed business decisions. Make sure to document all income and expenses, and keep all receipts and invoices.

3. Create a budget: Having a budget in place will help you manage your finances and make sure you are on track to meet your financial goals. Create a budget that includes both your fixed and variable expenses, and review it regularly to make sure you’re sticking to it.

4. Seek professional advice: If you’re unsure about any aspect of your finances, don’t hesitate to seek professional advice from an accountant. They can provide you with the guidance and support you need to make informed decisions.

5. Stay organised: Stay organised and keep all your financial documents in one place. This will make it easier for you to access the information you need and to keep track of your finances.

By following these tips, you’ll be able to manage your finances effectively and ensure the long-term success of your business. If you need help or have any questions, feel free to reach out to our team of experienced accountants at Luks Consulting for personalised advice and support

4 January 2023 - quick boast time.

Welcome to 2023! I would like to put a quick boast up following an email I received from a client recently.

10 October 2022: Stage 3 tax cuts - what are they all about?

Stage 3 tax cuts have been in the media recently but what do they mean and who do they impact?

The tax cuts are part of a package designed back in 2018 that was meant to come into effect on various dates. Stages 1 and 2 were brought forward due to COVID incentives however the 3rd and final stage is due to kick in on 1 July 2024. It’s a revamping of individual tax brackets where those earning above $45,000 who usually pay 32.5c in tax for every dollar earned above $45,000 will only pay 30c in the dollar. Those earning above $120,000 will also only pay 30c in the dollar instead of 37c in the dollar.

This reshuffle of income tax rates would benefit 78% of taxpayers; those earning more would see more benefit. For example someone on $60,000 per annum would be $400 better off whereas an income of $200,000 would see $9,000 less tax. This is why the tax cuts are controversial – they’re saving the high income earners more in tax, not helping those on lower incomes, and the money isn’t flowing into the economy in a time when we’re barrelling towards a recession. While we all want to pay less tax it seems that maximising these savings for higher income earners isn’t what the public wants.

the tax cuts are still on the table however it’s likely that they’ll be amended prior to the next budget.

22 August 2022: How to not pay Fringe Benefits Tax on vehicle benefits

Fringe Benefits Tax, or FBT as it’s more commonly referred to, is a tax levied on employers that provide benefits to their employees in lieu of a wage. Common examples are payment of school fees on behalf of an employee and the provision of a motor vehicle to an employee. In this second circumstance the employer would own the vehicle and claim all associated running expenses, even if they are incurred for private purposes by the employee. The ATO are quick to pounce on these arrangements because the provision of a vehicle to an employee is a financial benefit in relation to their employment, therefore it should be taxed. Welcome to FBT – the employer pays a whopping 47% of the grossed-up (read: almost doubled) taxable value of the vehicle benefits. This figure can change depending on the employee’s work usage of the vehicle and any after-tax contributions they make towards the running of the car but the end result is that the ATO is deterring people from paying untaxed financial benefits to workers.

Typically employees contribute towards the running costs of the vehicle to the point where FBT is reduced to nil.

There is, however, some light on the horizon. In their election promises Labor promised to scrap FBT if the motor vehicle provided was an electric one. This would mean that employees would not need to contribute to the running costs at all – vehicles could be provided to workers with no FBT ramifications at all.

At this stage the bill has been introduced to parliament so hopefully it sails through and we can enjoy the environmental benefits that EV ownership should assist in ushering in.

16 June 2022: A quick update about invoice reminders in Xero – how they help improve cash flow

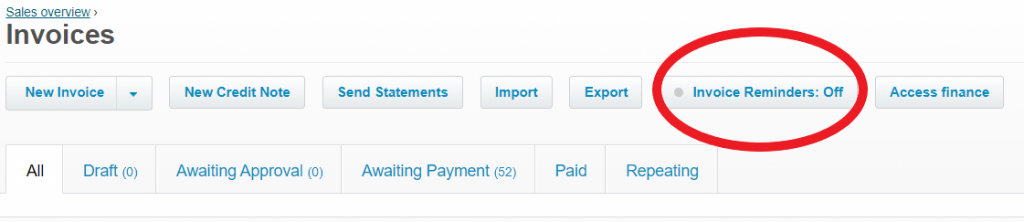

A quick bite today – a simple reminder on how enabling invoice reminders in Xero or your other accounting package can help with cash flow.

As the saying goes ‘cash is king’. This is true now more than ever, seeing as cash in the bank allows you to pay your employees, your suppliers and your other liabilities. Making sales is great and growing revenue is a sign of a solid business but if you’re not converting those sales to cash in the bank then you’re essentially financing your customers by extending them credit when you could be using the funds to grow your own business further.

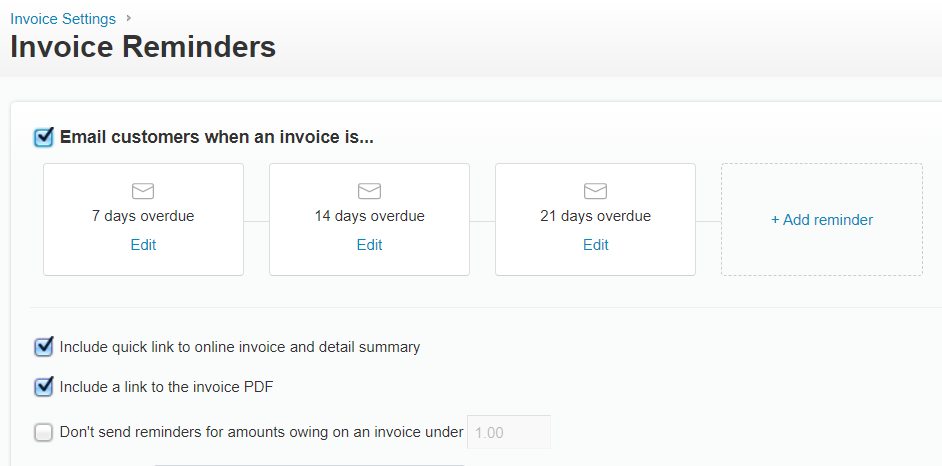

Chasing payments can be messy and most people don’t want to pick up the phone or send the email asking customers that they have built relationships with to pay up. This is where invoice reminders come in – a simple click of a box in Xero or other software and your customers will be notified within a certain period if they haven’t paid. The messages can be customised to start off nice and get more urgent as time goes on.

I would have email reminders kick in one to two days after they become overdue. This gives you time to receipt any payments against invoices in Xero that might come in right on the due date.

Having reminders in Xero works only if you’re regularly allocating receipts against invoices as they come in – if a customer makes a payment that isn’t receipted in Xero by you then the customer will still get a reminder. This can be bad for your image so is good to stay on top of.

Of course, enabling invoice reminders, while effective, is only part of the solution. Recalcitrant payers should be kept on top of because as time goes on, debts get more and more difficult to collect. Invoice reminders should be maintained alongside a solid initial contract of terms and conditions and internal processes where debtors are not left to become stale.

1 April 2022: Federal Budget impacts on small business and individuals

The 2022 federal budget was handed down on Wednesday evening and it pulled a few punches. There was not a huge amount of substance in it, and I was on the lookout for items relating to small business and individuals, largely around the tax side of things because you know, it’s what I do…

One item that stood out for me though was the announcement that the government would be reducing its spending on climate action by 35% over the next five years. On the face of it this does not appear to be a smart move, considering our timeframe to reduce the impacts of climate change is small and is getting smaller every day.

With the above exception, the below are the highlights and lowlights from the budget:

1. Individual taxes – while tax rates aren’t changing an additional tax offset of $420 will be paid to people earning up to $126,000 per year. This will also be in addition to the low and middle income tax offset for those eligible. This means low and middle income earners will be eligible for up to $1,500 back in their returns. Of course, if you owe the ATO money for the year this will come off any amounts owing. But still, you’re in front.

2. Small businesses investing in technology and training – Small businesses investing in certain training and digital tech will be able to claim 120% of the cost of these expenses such as EFTPOS machines, cloud software subscriptions and cyber security. The training needs to be provided in Australia by training organisations registered in Australia and does not cover in-house training.

3. Small businesses looking to put apprentices on – additional incentives to put apprentices on were announced, such as $5,000 for new apprentices in priority industries, and $15,000 wage subsidies for employers who take on new apprentices.

As an additional point of interest, the ATO are receiving additional funding to chase tax avoiders – large multinationals, large groups, trusts and wealthy individuals. This should raise some additional revenue for the government to pay for all of those new apprentices!

There were obviously a raft of other measures, so to see a comprehensive outline of these I feel the ABC’s coverage is the tidiest: https://www.abc.net.au/news/2022-03-29/federal-budget-2022-winners-and-losers/100914858

1 February 2022: NSW government releases slimmed-down support measures for small business

The NSW Government has recently announced new business support measures for those hit hard by the Omicron wave. With business confidence at their lowest level in quite some time, capital is running low for a lot of owners.

The current situation seems to be a perfect storm between enormous case numbers in the state making people concerned about getting out and about, and workers needing to isolate once they contract COVID. This means businesses don’t have capacity to operate in many circumstances and are needing to close the doors for days at a time.

The new measures provide for 20% of payroll to be paid in February if turnover was down 40% in January. Whether this is a fortnightly comparison or not has not been published. The minimum payment is $500 per week for businesses with turnover between $75,000 and $50m.

The measures also provide for the little-used Small Business Fees and Charges rebate to be increased from $2,000 to $3,000. These funds can be used to fund RATs for staff

Finally, the Commercial Landlord Relief has been extended to 13 March, so if you’re paying commercial rent it’s definitely worthwhile discussing your circumstances with your landlord.

11 October 2021: Director IDs needed soon for company directors

If you thought there wasn’t enough compliance in small business then you’re in luck! Company directors are about to get hit with another requirement; from November 2021 directors will need to have a unique number, called a ‘Director ID’ that will remain with them for life.

Directors will need to apply for their IDs themselves because they need to verify their identity. Prior to April 2022 anyone applying to be a director for the first time will need to apply for a number within 28 days of their appointment. After 5 April 2022 any new applicants will need to apply for the ID prior to being appointed.

Existing directors will have a year to apply for their director ID.

This system is designed to prevent companies from appointing fictitious board members, or from phoenixing companies. A phoenix activity is where a company is wound up with its assets transferred to another entity. The liabilities stay with the old company, which leaves many suppliers, and usually the ATO, owed significant amounts. Recovery of funds is incredibly unlikely.

13 July 2021: Cash Boost for employers and other businesses due to Sydney lockdown

The federal and NSW state governments have teamed up to provide a weekly payment to businesses forced to close or those that have experienced a decline in turnover of more than 30% due to the Sydney lockdown.

This will be similar to the JobKeeper scheme previously on offer. Businesses will receive 40% of their payroll bill, with a minimum of $1,500 per week and a maximum of $10,000. Small non-employing businesses will receive $1,000 per week. This will run until the lockdown ends.

In order to be eligible, businesses must retain their existing staffing load as at 13 July 2021, earn income greater than $75,000 per annum, and have experienced a decline in turnover of 30% or more when compared to a period in 2019.

No information has been released as to whether there are any alternative tests for businesses that have experienced growth, or were not in business in 2019, as was the case under JobKeeper.

More information will be provided as it comes to hand. Any questions – hit me up!

12 May 2021: Federal Budget Update

The night accountants and economists dream of: Budget Night. Coming off the back of the economic impacts of COVID and the economic boosts surrounding it, the government had some work to do to encourage business and consumer spending. Being an accountant focused on tax and business I’ll cover off some of the highlights of those realms. For a decent, more in-depth review I would recommend the ABC’s coverage here: https://www.abc.net.au/news/2021-05-11/federal-budget-2021-winners-and-losers/13328556

Individual tax rates: The lower tax rates introduced in the 2020-21 year are here to stay so aren’t really anything new. Nor is the Low and Middle Income Tax Offset (LIMTO, or “That thousand bucks Scotty from Marketing is giving everyone back in their tax” your mate at the pub might be talking about) going anywhere. This offset is here until 30 June 2022.

Low income earners and super: Superannuation is not currently payable if an employee earns less than $450 per month. The government is proposing to remove this cap so super will be payable on all income earned, regardless of income. This is expected to boost the super accounts of hundreds of thousands of workers, predominantly women. The long term impact will also mean that there should be less reliance on the public purse when these workers retire.

Small business: The temporary full expensing of assets such as motor vehicles and large equipment, set to expire on 30 June 2021 has been extended to 30 June 2023. This ties in with the loss carry-back rules, which state that a tax loss can be set off against a tax bill in prior years from 2018-19 onwards. This will be a huge help to those businesses suffering ongoing business impacts from COVID that had a tax bill in prior years.

There are a number of more targeted measures such as a tax offset for digital games produced in Australia and small beer and wine brewers.

To check out the rest of the measures hit up the link above. And to see how these tie in with your business or other affairs give me a shout.

7 May 2021: Working from home? You still need to keep records

COVID-19 saw many of us working from home on a full-time basis. Despite restrictions being wound back and workers easing back to a more normal working environment the opportunity remains for a lot of people to continue splitting their work time between home and the office.

Prior to COVID the ATO set a rate of 52c per hour that is designed to capture the additional running costs associated with a home office, being water usage, electricity usage, cleaning and depreciation on office furniture. Any additional costs could be claimed directly such as work usage of home internet, phone and stationery. When COVID hit the ATO put out a revised working from home rate that would capture all costs, to remove the need to manually calculate the work related portion of home internet and phone usage. This rate was 80c per hour worked from home and it suited the majority of taxpayers better than the ’52c per hour plus a portion of other costs’ method.

A lot of people will guesstimate their hours worked per week, multiply that by 48 working weeks, then multiply that by 80c to get the deduction. If the ATO knocked on your door this wouldn’t be good enough to substantiate a deduction. The tax office require a diary covering a four week period that you worked from home, detailing hours worked per day. This four week period can’t be a time you worked from home that was unusual – it has to be ‘representative’, or typical of what you do on a four-weekly basis.

Of course you can claim using a more direct method if it suits you better – this is all of your running expenses based on a reasonable method. The ATO have a handy home office expenses calculator on their website which is a pretty useful tool.

As always, if you need to know any more about this, feel free to get in touch.

Don’t forget Mum on Mother’s Day on May 9! I’ll make sure to get in touch with my Mum, Chris, on Sunday and will be aiming to give my wife a bit of peace and quiet from our rowdy boys on the day.

28 April 2021: Single Touch Payroll to be mandatory for business owners and family members

For those businesses employing staff Single Touch Payroll will be a common term. It’s the ATO’s requirement for employers to communicate details of every payrun for every employee – gross pay, PAYG withheld and super that has accrued. The ATO have only made this mandatory for unrelated staff of the business. Business owners, family members or other beneficiaries are referred to as ‘closely held payees’ and have been exempt until 30 June 2020. This has now been extended to 30 June 2021.

This means that, from 1 July 2021, all staff of a business, including the owners, need to have their wages and super accruals reported to the ATO via Single Touch Payroll. But what if you’re the owner of a business and you draw your wages here and there – taking payments from the business account as they’re needed rather than following a regular salary? The ATO have released guidance stating that these arangements can be reported quarterly. This can be done in a number of ways – either through STP reporting software on a regular basis, or quarterly based on actual payments or a percentage of payments taken in a previous year. Confused? You’re not alone – it will be a learning curve for all parties and there are a lot of businesses in this boat so keep an eye out for future developments.

Now, onto future developments the ATO have released Single Touch Payroll Phase 2. This isn’t changing the reporting too much, aside from having more data being provided to the ATO and the agencies it shares its data with. At the moment gross income is reported as a simple amount whereas this will be broken down in future to show what makes it up. Bonuses, allowances, lump sums, salary sacrifice amounts, child support deductions and other data will be sent to the ATO and onwards from there. Payroll providers will be busily updting their software to comply with the ATO’s requirements. It will also be imperative for employers to ensure their payroll categories are set up accurately within their software. The start date for this is 1 January 2022 so I’ll be keeping an eye out for updates and any action needed on this front.

22 March 2021: Natural Disaster relief loans for small businesses and others

With the government’s announcement that the March 2021 floods are a natural disaster, small businesses, primary producers, sporting and recreation clubs and not for profits can apply for a loan of up to $130,000 with no interest payable for two years, and low interest after that, for up to 10 years.

These loans are designed to assist small businesses and other organisations repair any damage caused by the floods that is not covered by insurance.

There are a few eligibility requirements such as being restricted to businesses that are located within an area that has been designated as a natural disaster zone, and it can’t be used to grow a side-hustle; the business has to be your main gig. The funding must also be urgently and genuinely needed, and can’t be used to repay old debt or cover expenses that existed prior to the floods.

For more information, and to apply please have a look at the government website: https://www.raa.nsw.gov.au/disaster-assistance/disaster-recovery-loans/small-business

11 March 2021: Post-JobKeeper incentives announced

Following a growing number of businesses jumping up and down about extending JobKeeper past 31 March the government have announced their support packages for when the scheme is turned off at the end of the month.

Scott Morrison has announced that support will come largely in the form of half price plane tickets to tourism areas hit hard by border closures and social distancing requirements. The good news is if you were planning a trip to Queensland with the family you stand a good chance of having the government pay half your plane fare!

For a specific duration from 1 April fares to specific airports on specific airlines will be subsidised – mainly in the Sunshine State, with a few other destinations thrown in such as Kangaroo Island and Merimbula.

In addition to half price plane tickets, the government has announced an extension to its small business loan guarantee scheme. The scheme has also been expanded to include bigger businesses (up to $250 million in revenue) and sees the government shouldering a bigger portion of the guarantee. This was formerly a government guarantee that, if the business failed to repay its loan, the taxpayer would shoulder 50% of the amount owing whereas this has now been increased to an 80% guarantee. This should have the effect of banks lending larger amounts to businesses that will, in turn, utilise the borrowed funds to expand their operations. This will tie in nicely with the JobMaker scheme for new staff put on the books.

The scheme is limited to businesses that received JobKeeper from January to March 2021 and those that received funding in the first round.

As always, if you’ve got any queries give me a shout – I’m here to help.

8 March 2021: Government funding and grants for small business

The economic fallout from COVID has been significant, which is news to nobody. Things could have been a lot worse, and we’ve come through the storm relatively well however the federal and state governments are still keen to ensure there’s a robust economy once JobKeeper is turned off and once society can return to some degree of normality.

To this end there are a number of grants and other funding mechanisms out there for small businesses looking to grow and become sustainable into the future.

The biggest incentive at the moment would be JobMaker – a cash incentive to businesses that are looking to employ staff that have formerly been on some form of income support (JobSeeker, Youth Allowance and others) and are between certain ages. If you’re looking to put staff on this is definitely worth a look.

I’m currently assisting a client apply for a grant the Federal Government are putting on to grow manufacturing in Australia. My client is being offered funding to attend a tradeshow where he will showcase his wares and be exposed to a much bigger audience than he would otherwise have been able to access. This will provide a major boost to his business at a critical stage of its life-cycle.

There are a range of these incentives and knowing how to apply for, report on and remit the funding can be complex. Give me a call if you’d like more information on accessing these opportunities for your own business.

1 March 2021: ATO looking to recoup some cash once JobKeeper tap turned off

The ATO has been sitting on an increasing pile of debts owing to it and industry experts are saying this will be called in once JobKeeper is switched off at the end of March 2021. The ATO took a very soft approach to businesses and individuals during COVID and now that things are getting back to normal this attitude is looking to change.

We’ve already seen more activity from the ATO over the previous few months with calls and letters following up outstanding lodgements and overdue amounts owing. The ATO also drew staff from other areas of the organisation to focus on JobKeeper and Cash Flow Boost administration and queries. It would seem these staff members are to be allocated back to areas such as debt collection and chasing outstanding lodgements.

It’s imperative to stay up to date with your lodgements as this avoids penalties from the ATO. It’s usually a requirement for other business needs such as applying for finance. Even if funds are tight and full payment is not an option the ATO are usually comfortable entering into payment arrangements to settle amounts owing.

If you’re behind in your lodgements please contact us so we can put a plan in place to bring things up to date

July 2020: COVID-19 support

Incentives have been put in place by a number of departments in order to cushion the impact of COVID-19. Read the below for an update on the current measures and how they might apply to you and your business.

|

|